Waga Energy Confirms Its EBITDA Breakeven Objective

Waga Energy Confirms Its EBITDA Breakeven Objective in the Course of 2025 Thanks to Its Strong US Momentum and to the Improvement of Its 2024 EBITDA

Strong financial performance in 2024:

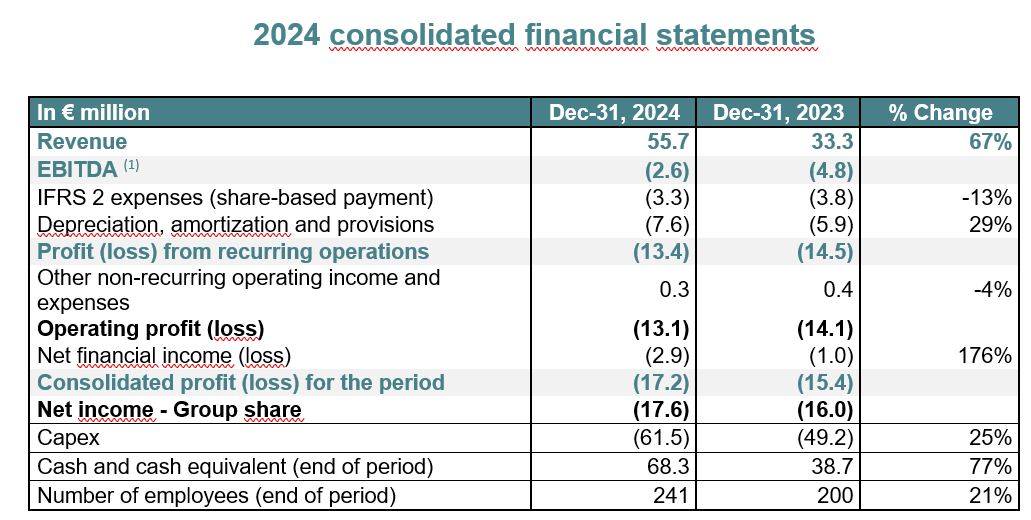

– Full-year EBITDA of -€2.6m (+€ 2.2m yoy), including -€ 0.1m in H2, confirming the EBITDA breakeven target in the course of 2025.

– Very strong revenue growth at € 55.7m (+67%), driven by biomethane production revenue (+81%).

– € 170m signed annual recurring revenue to date[1].

– Commercial momentum accelerating with 10 contracts announced in 2024, 3 in 2025[2], and a commercial pipeline of 16.8 TWh / 57 mm MMBTu p.a. (+40% YoY), strongly driven by the U.S. market, where Waga Energy’s solution is becoming a reference.

– Outstanding operational performance on construction (10 projects launched in 2024) and RNG production (+72% to 576 GWh / 2 mm MMBTu, avoiding 142,000 tons of CO2-equivalent emissions1).

– Strong financial position: liquidity of € 182m (including € 68m cash and € 114m available undrawn debt), plus an additional € 24m debt already raised in 2025.

Mathieu Lefebvre, Chairman & Chief Executive Officer of Waga Energy, stated: “2024 confirmed Waga Energy’s accelerated international expansion, marked by the launch of 10 new projects in North America and Europe. The Group is now firmly established in these two strategic markets, where portfolio opportunities are becoming a reality, and is well positioned to expand its footprint into other regions — particularly Latin America, following the recent opening of our subsidiary in Brazil. In an uncertain global economic environment, our world-unique technology and unmatched execution capabilities provide decisive competitive advantages to drive further growth, especially in the United States. The improvement in our EBITDA, driven by increased revenues and cost control, reinforces our confidence in achieving breakeven in the course of 2025.”

Waga Energy (EPA: WAGA), a leader in the production of Renewable Natural Gas (RNG) from landfill gas, today reports its financial results for the fiscal year ended December 31, 2024. Consolidated revenues are now 47% outside of France and reached € 55.7m, up +67% yoy, driven by growth in RNG production revenues (+81%) and equipment sales (+35%).

Boosted by higher revenues and disciplined cost management, the 2024 EBITDA stands at -€ 2.6m (+€ 2.2m yoy), with -€0.1 m in H2 2024 (+€ 2.4m yoy), demonstrating the Group’s ability to achieve EBITDA breakeven in 2025.

Waga Energy’s profitable growth model is confirmed with :

– Strong growth perspectives notably in the US where the Wagabox® solution is now becoming a market reference, illustrated by 4 gas rights and 3 offtake contracts signed since December

– +€ 17.5m[3] of Projects EBITDA which are expected to strongly grow notably thanks to the € 170m signed annual recurring revenue to date, whereas platform costs currently at -€ 20,1m will grow more moderately

– A strong conversion of Projects EBITDA into Projects cashflows (the +€ 17,5 m Projects EBITDA having generated +€ 16.9m Projects[4] cashflows in 2024).

Waga Energy maintains a strong total liquidity position of € 182m as of December 31, 2024 (including € 68m in cash and € 114m in available undrawn debt). The Group raised € 223m in financing during 2024 through equity and debt, with a 46% debt-to-equity ratio (+9 pts yoy), gearing up to leverage its balance sheet towards its debt capacity full potential. An additional € 24m corporate debt increase has been signed on April 11, 2025.

Waga Energy has maintained a high level of operational performance, achieving an average uptime of 94.3% for WAGABOX® units that have been in operation for over 12 months, while also commissioning 10 new units. The Group’s portfolio (owned or sold) injected 576 GWh / 2mm MMBTu of RNG (+72% YoY), avoiding the emission of 142,000 tons of CO2-equivalent by displacing fossil natural gas in energy grids.

The Group also delivered strong commercial performance, announcing 10 new projects in 2024 (6 in the United States, 2 in France, 1 in Canada, and 1 in Italy), plus 3 additional projects since the start of 2025 (1 in France, 1 in the United States, and 1 in Spain). In an environment that remains favorable to RNG, particularly in the U.S., Waga Energy strengthened its commercial pipeline, which now includes 197 projects representing a potential installed capacity of 16.8 TWh / 51 mm MMBTu p.a. (+40% yoy) — excluding projects portfolios being developed.

Waga Energy maintains its target of achieving EBITDA breakeven in the course of 2025, underscoring the relevance of its profitable growth model. Furthermore, the number of projects signed to date and prospective signings, particularly in equipment sales, confirms the few months time shift in the 2026 targets of ~ € 200m revenue and 4 TWh p.a. installed capacity, mentioned during the 2024 revenues release on February 10, 2025. The target of over € 400m signed annual recurring revenue by the end of 2026 is maintained.

The company will provide an update on its guidance at the end of September during the presentation of its H1 2025 results.

In an uncertain market environment, particularly due to the potential implementation of custom duties, the context remains highly favorable for Waga Energy, thanks to the competitiveness of its world-unique technology and unmatched execution capabilities, which represent key competitive advantages to sustain its trajectory of strong and profitable growth, especially in the United States, based on projects generating highly predictable cash flows.

Next release:

Publication of H1 2025 results on September 29, 2025.

[1] Cf glossary

[2] 10 new contracts announced in 2024 of which 1 signed in 2023, and 3 new contracts announced in 2025 of which 2 signed in 2024.

[3] Including RNG, EPC and O&M.

[4] Projects EBITDA – capex

Comments