Strong Increase in Revenue Driven by Commissioning 5 New Units

Strong Increase in Revenue (+87% yoy) Driven by the Commissioning of 5 New Units, and Improved EBITDA yoy

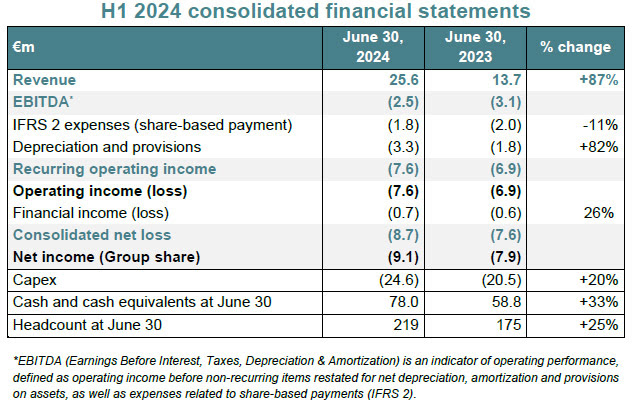

- Strong increase in consolidated revenue at €25.6m (+87% yoy) thanks to the commissioning of 5 new WAGABOX® units, including a first unit in the United States, international now represents more than 50% of revenues.

- 254 GWh (866,648 MMBtu) of renewable natural gas (RNG) injected from captured biogas in France, Spain, Canada and the United States (+79% yoy), avoiding the emission of 63,000 tons of CO2 eq.

- Improvement in EBITDA at -€2.5m (vs. -€3.1m in H1 2023).

- 15% increase in the sales pipeline versus the level of the Capital Markets Day held in February at 13.6 TWh p.a. (46,405,126 MMBtu) with 165 projects, in a favorable market environment for RNG allowing to guarantee attractive prices over long periods in Europe and the United States.

- Very robust financial position with cash of €78m, strengthened by the €52m capital increase and debt-raising of nearly €160m since the start of the year, including €100m in inaugural corporate debt, not yet drawn.

Mathieu Lefebvre, Chairman and Chief Executive Officer of Waga Energy, commented:

“Our success in the United States was confirmed by the commissioning of a WAGABOX® unit in New York State, and two new contracts won in North Carolina and Texas. Looking to the months ahead, the depth of this market and solid RIN levels will enable us to accelerate further. In Europe, renewable natural gas (RNG) development is supported by the decarbonization drive and rising natural gas prices in connection with an increased dependence on liquefied natural gas (LNG) imports, at a time of declining electricity prices. In this favorable context and leveraging on substantial financial resources on the back of our recent successful debt and equity raising, we continue to deliver a positive impact on the planet and have full confidence in our ability to achieve our financial targets.”

Waga Energy (EPA: WAGA), a leader in producing Renewable Natural Gas (RNG) from landfills, today reports its first-half results for the 2024 fiscal year, as approved by the Company’s Board of Directors on September 27, 2024. The Group achieved strong revenue growth at €25.6m (+87% yoy), with an improvement in EBITDA totaling -€2.5m (vs. -€3.1m in H1 2023) thanks to the revenue increase and to the improvement of the RNG sale & upgrading services gross margin rate.

This strong growth was fueled by RNG production, amounting to 254 GWh (866,684 MMBtu, +79% yoy) thanks to the Group’s operational excellence in running its production units, and the commissioning of 5 new WAGABOX® units (4 in France and a first US unit).

A Sales Pipeline of Over 13 TWh P.A. Installed Capacity

The buoyant market environment for RNG bolsters Waga Energy’s pricing power, as demonstrated by high prices for RIN (“Renewable Identification Numbers” – a mechanism assessing the value of green gas in the United States), and the execution of the first long-term private BPA (“Biomethane Purchase Agreement”) in France at a higher price than the State-subsidized tariff.

In this favorable environment, H1 saw the Group grow its sales pipeline by +15% versus the level of the Capital Markets Day in February for an installed capacity of 13.6 TWh/year (46.4 million MMBtu) including 165 projects, and secured as well two US contracts.

Stronger Financial Position

At June 30, 2024, the Group had cash of €78m, strengthened by its successful €52m capital increase in March and nearly €160m in debt-raising since early 2024, including $60m in US construction debt with Eiffel Investment Group in February and €100m in inaugural corporate debt with 5 banking groups in July, not yet drawn. This robust financial position provides Waga Energy with the resources required to finance its growth.

Continued Excellent Operational Capacity

As of the date of this press release, the Group operates 28 RNG production units in France, Spain, Canada and the United States, representing an installed capacity over 1 TWh/year (3.4 million MMBtu). An additional eleven units are under construction in France, Canada and the United States, and set to increase installed capacity by a further 1.3 TWh per year (4.4 million MMBtu).

Through its installed base, Waga Energy avoided emissions of 63,000 tons of CO2 eq. in H1 2024 by replacing fossil natural gas(1).

Annual signed recurring revenue based on operational units and projects under construction totaled €106m, versus €80m a year ago (+33%).

On the back of these strong results, the Group confirms its targets:

- EBITDA breakeven in the course of 2025;

- Revenue of ~€200m in 2026;

- Installed capacity of ~4 TWh per year in 2026;

- Annual signed recurring revenue in excess of €400m in 2026;

- Installed capacity to avoid emissions of 660,000 tons of CO2 eq. per year in 2026.

Next release: publication of 2024 revenue on February 10, 2025 after close of trading.

About Waga Energy

Waga Energy (Euronext Paris: FR0012532810, EPA: WAGA) produces competitively priced Renewable Natural Gas (also known as “biomethane”) by upgrading landfill gas using a patented purification technology called WAGABOX®. The RNG produced is injected directly into the gas distribution networks that supply individuals and businesses, providing a substitute for natural gas. Waga Energy finances, builds and operates its WAGABOX® units under long-term contracts with landfill operators for the supply of raw gas, and generates income by selling the RNG it produces or by offering a purification service. As of the date of this press release, Waga Energy operates 28 (directly owned or sold) RNG production units in France, Spain, Canada and the United States, representing an installed capacity over 1 TWh/year (3,412,960 MMBtu). Each project initiated by Waga Energy contributes to the fight against global warming and helps the energy transition. Waga Energy is listed on Euronext Paris.

[1] Estimate using comparative emission factors for fossil natural gas and Renewable Natural Gas, as calculated by ISCC (International Sustainability & Carbon Certification) for France and Spain, the “CA-GREET” model for the United States and the grid of gas distribution company, Énergir, for Canada.

Comments