Market Reset: Why 2025 Is a Defining Year for the U.S. Biogas & RNG Industry

Written by Zoe Astill, BiogasWorld

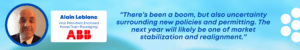

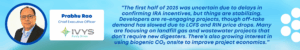

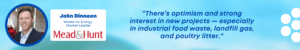

In BiogasWorld’s recent webinar, “The US Biogas & RNG Market: Navigating 2025 and Beyond.” Hosted by Ryan Hart, Renewable Energy Analyst from BiogasWorld, we spoke to several industry professionals, such as Alan Lebanc, VP Enclosed PowerTrain Packaging, ABB, Prabhu Rao, CEO of Ivy’s Adsorption, Scott McKay, Business Development, Fournier Industries and John Dinneen, Waste-to-Energy Leader, Mead&Hunt.

Together, these leaders shared their insights on the future of renewable gas infrastructure, policy trends, and technology shaping the path toward 2030 and beyond. Here’s a forward-looking synthesis of what’s next for the U.S. RNG market.

Arriving at the Crossroad

After years of rapid expansion fueled by federal incentives and record-high renewable natural gas (RNG) valuations, the U.S. biogas market is entering a new era. From 2022 to 2024, developers, investors, and technology providers rode the momentum of the Inflation Reduction Act (IRA) and other clean energy policies that transformed biogas from a niche sector into a mainstream renewable energy opportunity.

But 2025 marks a shift — not a slowdown, but a reset.

The U.S. RNG market in 2025 is evolving from rapid expansion to strategic optimization. Developers are reassessing project economics, investors are scrutinizing risk profiles, and policymakers are fine-tuning guidance for long-term clarity. The question now becomes: what does this recalibration mean for the future of biogas and RNG development?

The U.S. RNG market in 2025 is evolving from rapid expansion to strategic optimization. Developers are reassessing project economics, investors are scrutinizing risk profiles, and policymakers are fine-tuning guidance for long-term clarity. The question now becomes: what does this recalibration mean for the future of biogas and RNG development?

The Aftermath of the Inflation Reduction Act: A Changed Market Landscape

When the Inflation Reduction Act was passed in 2022, it catalyzed one of the most significant growth waves the biogas industry has ever seen. The tax incentives spurred a surge of project proposals and financial commitments across the U.S. RNG market.

Developers leveraged IRA benefits to offset up to 30–40% of project capital expenditure (CAPEX), making previously marginal projects financially viable. However, as the initial boom settled, the market began facing new realities: regulatory clarification delays, complex tax credit qualification rules, and uncertainty over long-term credit monetization strategies.

Many projects hit a “pause” phase in late 2024 as developers waited for final guidance on lifecycle emissions modelling, credit stacking, and state-level compliance integration. This temporary cooling period has reshaped how the industry approaches growth — moving from rapid expansion to sustainable scaling.

Where the Growth Is Happening

Despite recalibration, opportunity is far from drying up. Certain feedstock sectors are experiencing accelerated development thanks to clearer ROI models and supportive policies.

The industrial food waste sector continues to expand, driven by landfill diversion mandates and corporate decarbonization goals. Landfill gas upgrading projects are also seeing renewed interest, especially as utilities and municipalities look to maximize methane recovery under tighter emissions targets. Meanwhile, poultry and agricultural waste projects are gaining traction, where anaerobic digestion is increasingly viewed as both a waste management and energy strategy.

These growth areas align closely with federal and state-level sustainability goals — particularly around methane reduction, circular economy principles, and local energy resilience. Developers, like Mead&Hunt, who are targeting these niches, are likely to benefit from clearer regulatory pathways and more predictable revenue streams.

The Bottlenecks Slowing Progress

Still, 2025 isn’t without its challenges. While the policy foundation is solidifying, practical bottlenecks continue to constrain project timelines and profitability.

Permitting delays remain a top concern. Interconnection backlogs with regional utilities are stretching timelines beyond initial projections, creating uncertainty in delivery schedules and financing milestones.

Additionally, off-take pricing challenges persist. Fluctuating LCFS credit values, coupled with evolving voluntary RNG market dynamics, are forcing developers to adopt more flexible contract structures. On the supply chain side, shortages of critical electrical and control components from 2024 are still impacting commissioning schedules and cost forecasts.

These headwinds are pushing the industry toward greater collaboration and more efficient project delivery models.

The Opportunity Ahead

Despite the turbulence, the outlook for the U.S. RNG market in 2025 remains optimistic. The industry has matured beyond the volatility of its early growth phase — and with that maturity comes a shift toward smarter project design, improved risk management, and technology integration.

Developers are prioritizing modular system design, digital monitoring tools, and performance-based partnerships. Investors, meanwhile, are showing a preference for portfolios with diversified feedstock sources and long-term offtake visibility.

In short, 2025 may not deliver the explosive growth of past years — but it’s setting the stage for a more sustainable, data-driven, and resilient future for U.S. biogas and RNG.

Coming next: In our next article, we’ll explore the technologies driving this efficiency revolution — including smarter gas upgrading systems shaping the next wave of biogas innovation.

Want more insights? Check out the webinar here: US Biogas & RNG Market: Navigating 2025 & Beyond

Comments